What is compound interest? This fundamental concept in finance plays a crucial role in how money grows over time, making it an essential topic for anyone looking to understand personal and corporate finance better.

Unlike simple interest, which is calculated only on the principal amount, compound interest takes into account the interest earned on both the principal and any accrued interest, which can lead to exponential growth in investments over time. The magic of compounding can significantly impact your savings, investments, and even retirement planning.

Understanding Compound Interest

Compound interest is a financial concept that refers to the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. Unlike simple interest, which is calculated only on the principal amount, compound interest allows investments to grow exponentially over time. For example, if you invest $1,000 at an annual interest rate of 5%, after one year, you would earn $50 in interest.

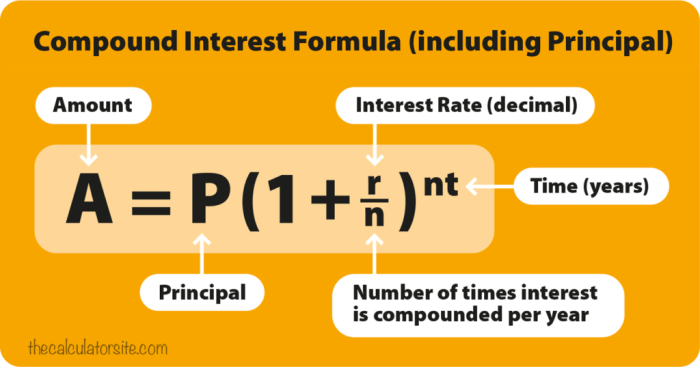

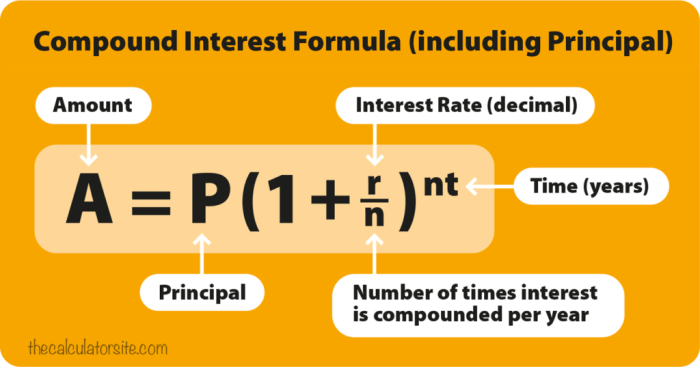

However, in the second year, you’ll earn interest on the new total of $1,050, leading to $52.50 in interest for that year. This process continues, creating a snowball effect that can significantly increase your returns.The formula for calculating compound interest is:

I = P (1 + r/n)^(nt) – P

Where:

- I is the interest earned,

- P is the principal amount,

- r is the annual interest rate (decimal),

- n is the number of times that interest is compounded per year,

- t is the time the money is invested or borrowed for, in years.

Importance of Compound Interest in Finance

Compound interest plays a critical role in personal and corporate finance, particularly in wealth accumulation and investment growth. It serves as a key factor in determining how much an investment will be worth over time, making it essential for anyone looking to grow their wealth.

- In personal finance, compound interest can dramatically increase savings for retirement. The earlier one starts saving, the more time the investments have to grow.

- For corporations, understanding compound interest is vital for strategic financial planning and investment decisions.

Investments that leverage compound interest can lead to significant growth, particularly over longer time frames, making it a central component of effective retirement planning.

Financial Professionals and Compound Interest

Finance professionals play a crucial role in guiding clients on how to effectively utilize compound interest in their investment strategies. Their expertise helps individuals and businesses understand the long-term benefits of investing early and consistently.Finance lawyers may also be involved in situations where complex interest calculations are at play, ensuring that clients are aware of their rights and obligations regarding interest rates.

Additionally, finance licenses enable professionals to provide informed investment guidance related to compound interest, which is essential for maintaining compliance and offering reliable advice.

Compound Interest in Financial Careers

Several finance careers require a strong understanding of compound interest, including financial analysts, investment bankers, and personal financial advisors. The essential skills for these finance specialists include:

- Analytical skills to evaluate investment options,

- Communication skills to explain complex financial concepts to clients,

- Technical proficiency with financial software that computes compound interest.

Having a solid grasp of compound interest can enhance career opportunities in finance, as it is integral to many financial products and services.

Financial Companies and Compound Interest

Many financial companies utilize compound interest to structure their products, including banks, investment firms, and insurance companies. For instance, savings accounts often compound interest monthly, while investment accounts may compound quarterly or annually.Banks and investment firms design their products around the principles of compound interest to attract customers and encourage long-term investment. Transparency in how these companies present compound interest to consumers is paramount, as it builds trust and enables informed decision-making.

Basic Financial Concepts Related to Compound Interest

Understanding the time value of money is fundamental to grasping compound interest. This principle asserts that money available today is worth more than the same amount in the future due to its potential earning capacity.A comparison of compound interest with other financial instruments highlights its advantages. For instance, unlike fixed deposits that may offer lower interest rates, compound interest provides greater growth potential over time.

Grasping these basic financial concepts aids individuals in making better investment decisions, as they can better appreciate the long-term benefits of investing early and strategically.

Impact of Finance Divisions on Compound Interest

Different finance divisions, such as personal finance and corporate finance, assess compound interest in varied ways. Personal finance focuses on individual savings and investments, while corporate finance evaluates how businesses can optimize their capital through strategic investments.Examples include how finance ministers incorporate compound interest in national financial strategies, such as encouraging citizens to save for retirement through tax-advantaged accounts. The implications of finance transformation underscore the need for a deeper understanding of compound interest across all sectors.

Compound Interest and Finance Technology

Technology has revolutionized the calculation and visualization of compound interest. Financial tools and apps are now available that help users simulate the growth of their investments over time, taking into account different rates of return and compounding frequencies.Advancements in finance technology facilitate better investment strategies involving compound interest, providing users with clear insights into potential growth and risks associated with various investment options.

Financial Statements and Compound Interest

Compound interest is reflected in financial statements in several ways, particularly in the balance sheet and income statement. It impacts financial reporting and analysis, as analysts must consider how interest accrues over time when assessing an entity’s financial health.Finance specialists interpret the impact of compound interest in relation to earnings and asset valuation, providing critical insights for stakeholders.

Strategies Incorporating Compound Interest

To maximize the benefits of compound interest, individuals should adopt effective strategies such as:

- Starting to invest early to leverage time,

- Making consistent contributions to savings and investment accounts,

- Avoiding withdrawals to allow the investment to grow.

Common mistakes include underestimating the power of compounding or failing to reinvest earned interest. Various scenarios and case studies demonstrate how strategic use of compound interest can lead to significant financial success, emphasizing its importance in investment planning.

Conclusive Thoughts

In summary, grasping the nuances of compound interest not only empowers individuals to make informed financial decisions but also highlights its significance across various financial sectors. Whether for personal savings or corporate investments, understanding how compound interest works can be a game-changer in achieving financial success.

Expert Answers

What is the difference between compound interest and simple interest?

Compound interest is calculated on the principal and the accumulated interest, while simple interest is calculated only on the principal amount.

How often is compound interest compounded?

Compound interest can be compounded annually, semi-annually, quarterly, monthly, or even daily, affecting the total amount of interest earned.

Can compound interest work against me?

Yes, if you have debt, compound interest can increase the amount you owe over time, such as with credit card debt.

How does compound interest affect my retirement savings?

Compound interest allows your retirement savings to grow more significantly over time, especially if you start saving early and make regular contributions.

Is there a limit to how much interest can be compounded?

There is no strict limit; however, the amount of interest that can be compounded depends on the initial investment, the interest rate, and the compounding frequency.